Lumada Empower Data Platform Trial Offer

Empower Data Platform harnesses the power of AI and machine learning to accelerate, automate, and simplify creating data ingestion.

Download the OfferFinancial institutions are adrift in a sea of data — product and service history, customer information, financial transactions, marketing campaigns, regulatory data, external benchmarking data, and more — sourced from various mobile applications, online activity, and in-branch interactions.

The promise of each different data point, whether first- or third-party generated, is that they inform financial services data management solutions for developing a better, more accurate, and deeper understanding of customers’ needs and wants. A Forrester study of European banks found that institutions rated as having leading customer experiences were the ones that empowered their service representatives with the knowledge and capability to quickly respond to customers’ individual needs and issues.

However, financial institutions face specific challenges in attempting to personalize their customers’ experiences. Beyond generating a 360-degree view of their customers and providing frictionless, omnichannel customer service, financial institutions need to navigate regulatory requirements, generate insights for broader cross- and upsell opportunities, as well as consolidate data from mergers & acquisitions. While data can provide valuable opportunities for addressing all these challenges, it can also create its own problems if the data is inconsistent across different systems and mishandled as a result.

The peril of bad or mismanaged data is magnified by the intense regulatory pressure placed on financial institutions, which can carry severe consequences for violations. For example, the Beneficial Ownership Rule (BFO), which is implemented and enforced by the Financial Crimes Enforcement Network, requires banks to identify all significant owners of legal entities and their accounts. A 360-degree view of a customer can quickly identify any illegal financial activities such as money laundering, tax evasion, or fraud, as well as other major crimes such as terrorism activity, allowing the financial institution to take timely action.

The risks and rewards of data collection are great, but thankfully both can be balanced through master data management for financial services organizations.

The Cost of Bad Data

“Poor quality data is a problem” isn’t exactly a revolutionary statement, but businesses across all sectors are guilty of underestimating how significant a problem bad data really is. Gartner reports that poor-quality data costs organizations an average of $12.9 million per year.

The good news is that inaccurate data doesn’t have to be a permanent problem. It’s leading causes — human error, departmental silos, data duplication, and so on — are easily identifiable, which makes it possible to plan around them. To craft a solid data strategy, you should first ensure that your existing data and any new data entering your systems meets the following criteria:

- Data must be accurate and free from error.

- Data must be complete and comprehensive, without any gaps in collection.

- Data must be consistent; the data stored in one system should not contradict that same data stored in another.

- Data must be standardized and input in the correct format.

- Data must be timely — that is, it must be collected at the right moment in time.

- Data must be up to date so that you have access to the most relevant information.

- Data must be legitimate and must be extracted from a credible source.

Establishing standards and oversight for data is just the beginning. To truly make use of this valuable resource, financial institutions must also take steps to unify customer data, break down data silos, and eliminate data isolation.

The Benefits of Effective Data Management

Not that long ago customer data was limited to surface-level information such as name, address, and transaction history. Today, a vast array of data arrives instantly from a host of different sources, from mobile applications and website portals to branch transactions and ATM interactions. Effective data management allows financial institutions to assemble a realistic, actionable, and up-to-date representation of their customers, which can create a more personalized experience for the customer and better insights for the institution.

- Being able to track each customer’s journey across different platforms and devices can create an instantly accessible, centralized, 360-degree view of customer profiles for every employee and stakeholder.

- Providing marketing systems with better access to customer data enriches marketing-defined business rules, more accurately profiles audience segments for future campaigns, and allows for accurate product-data matching.

- Customer service is enhanced by predictive customer analytics based on previous interactions and existing profiles, helping to manage and resolve real-time interactions in an efficient and satisfactory manner.

- Outbound omnichannel communication is hyper-personalized and directly targeted through the integration of different marketing technologies, such as marketing automation platforms (MAPs), real-time interaction management (RTIM), and email marketing services.

- A more comprehensive view of customer activity makes it easier to identify possible cases of fraud or illegal activities, allowing institutions to quickly take action to protect themselves and their customers.

- New cross- and upselling opportunities can be identified and promoted to existing customers, strengthening the customer relationship while boosting revenue.

Unfortunately, an expanded array of data inputs doesn’t automatically equal better insights into customers. Many departments contain data silos that hoard data, even though it could be of use to other departments and teams. That lack of communication also means much of that available data is duplicated and replicated within silos across institutions, causing inefficiencies and increasing the risk of errors.

The companies that were able to effectively analyze their data at scale — what a McKinsey study defined as breakaway companies — were those that succeeded in empowering decision-makers to achieve better business outcomes. These companies were reportedly 2.5 times more likely to have a clear data strategy and twice as likely to have strong data governance, foundational capabilities made possible by master data management.

What is Master Data Management?

Master data management (MDM) refers to collaboration across business units and departments in an organization in relation to the orchestration, enablement, and workflow of a given data domain. In the financial services sector, data domains typically include client, product, and assets. Mastering these domains provides a comprehensive view of all the data stored within those domains. Having a single consolidated database enables business users to:

- Identify the relationships between clients

- See which products a client already has (and which ones they don’t)

- Determine which regulations apply to each transaction for compliance purposes

- Detect fraud

- Simplify Right to be Forgotten requests

- And more

A key concern for MDM is security. Managing who has access to business-critical information, who gets to make changes to that information, what kind of changes can be made, and when those changes will be enacted is challenging. MDM provides a single location for managing these changes and gives clarity on how they affect all business units.

MDM is designed to be an “active data” solution that keeps enterprise systems synchronized. For example, you could use a data service to automatically capture, verify, store and distribute/synchronize client information, categorize individuals based on where they are in the sales pipeline, and so on. This ensures that the right data is captured at the right time and that that data is accurate, consistent, and up to date. This can be challenging given the fact that financial institutions often draw data from multiple sources, some of which churn out “ugly” or inconsistent data. This data must be cleaned up and made consumable so that business users can utilize it to make more efficient decisions around which markets to target, how to prevent fraud, how to upsell and cross-sell to customers, and so on. Therefore, a key element of MDM is screening data before it is entered into the system in order to ensure that it meets a bank’s data quality standards.

Roadmap to Financial Services Data Management

As with any successful data strategy, proper financial services data management requires careful consideration and planning. First and foremost, you need to establish the scope of your MDM project — that is, define key business areas and which data needs to be governed. To do the latter, you must determine which domains are the most critical to master, how those domains affect your organization, and what the potential risks of not managing that data are.

From there, you need to create an inventory of all of your existing data sources and figure out which ones you can afford to eliminate and which ones you can consolidate. In most instances, it’s possible to replace multiple smaller systems with a single, more robust solution. The fewer systems there are to keep track of, the easier it is to create a central repository and enforce good data hygiene.

During the scope stage, you’ll also need to choose your implementation style. There are four common MDM implementation styles:

- Consolidation: Master data is consolidated from multiple sources to create a golden record, which serves as a single source of truth.

- Coexistence: Similar to Consolidation style, master data is consolidated from multiple sources and stored in a central MDM repository and updated in its source systems.

- Registry: Duplicates are identified and eliminated by comparing data across multiple systems, and unique global identifiers are assigned to matched records.

- Centralized: Master data is stored in a central repository, where it is enhanced and then returned to its respective source system.

Note that choosing an implementation style can be challenging for financial institutions that have acquired multiple companies over time because they need to figure out how to manage those companies.

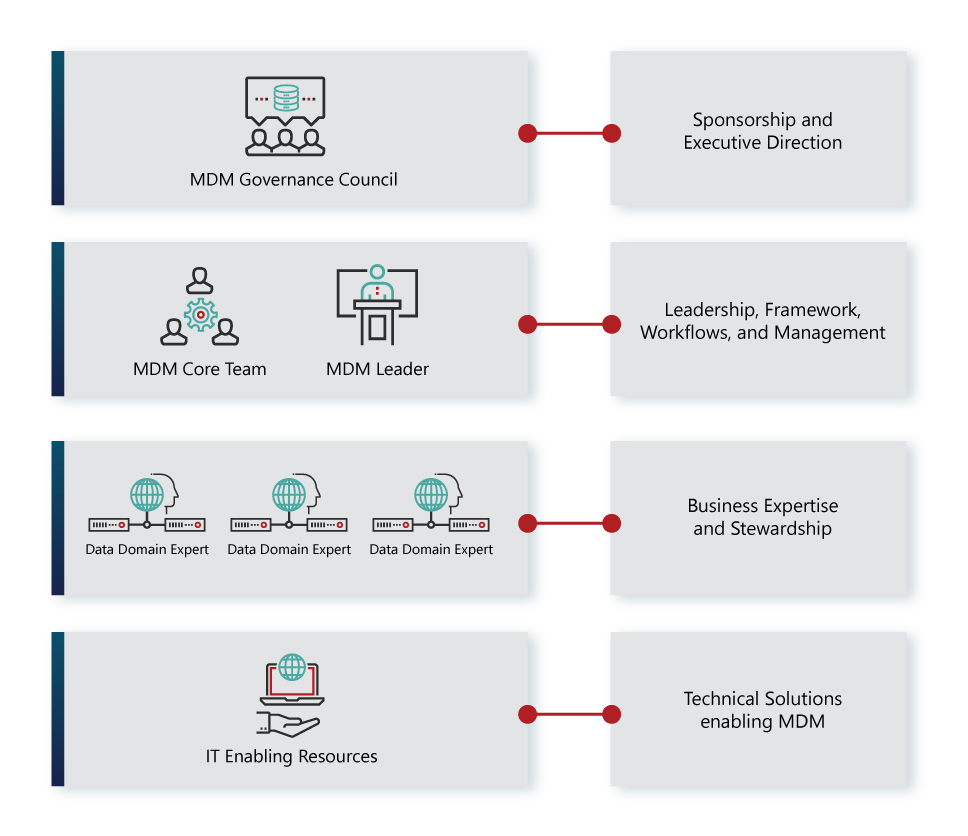

Once you’ve established the scope of the project, you’re ready to create an organizational structure similar to the one shown in the chart below:

Each and every individual included in this structure plays a key role in ensuring the overall success of your financial services data management project. For example, your MDM Governance Council should, ideally, consist of a small group of company leaders responsible for sponsoring the program, setting its direction, and issuing final approval on scope, structure, and processes. Your MDM Core Team should create and consistently update MDM supporting structures and provide leadership for other team members, and your IT Enabling Resources should include data analytics responsible for profiling, cleansing, enriching, and auditing data.

Now that you’ve created your organizational structure, you need to figure out which processes you’ll need to manage it and which technology you’ll use to support it.

At the end of all of this, it’s important to note that master data management for financial services is a combination of people, processes, and technology. It’s possible to master data without technology — but without people and processes in place, no technology can give you what you really need.

Banking MDM Implementation Do’s and Don’ts

There are a few simple do’s and don’ts every financial institution should observe in order to guarantee the success of their MDM project:

| DO remember to address organizational change management. | DON’T underestimate the critical importance of executive buy-in. |

| DO look at ways to productize your data and find additional ways to generate revenue from it. | DON’T take a technology-first approach. |

| DO balance governance needs and business benefits. | DON’T neglect to include portions of the MDM roadmap. |

| DO take small steps in incorporating different systems and different businesses. | DON’T treat MDM like a one-time cleanup. |

| DO have a roadmap to gather all the business data, both structured and unstructured. | DON’T stop with MDM — turn it into a business asset through revenue opportunities, efficiencies, and new businesses. |

| DO look at predictive analytics, robotics, artificial intelligence, and other gateway solutions toward enacting MDM. | DON’T take a one-size-fits-all approach. |

Consolidate Your Data With Hitachi Solutions

Take the guesswork out of financial services data management by partnering with a dedicated team that’s navigated these waters before. At Hitachi Solutions, our team uniquely integrates advisory services, technology innovation, delivery excellence, and value-added security and support to eliminate the friction that comes with digital transformation. We take a technology-agnostic approach to data management in banking, which enables us to work with clients from any background, on any system.

Explore the essential components for creating personalized customer experiences in our customer data platform white paper.

Get the WhitepaperBest of all, we won’t just lead you through the MDM process — we’ll collaborate with you every step of the way, so you can take ownership over your achievements and develop the confidence to tackle any challenge that comes your way. Get in touch with the Hitachi Solutions team today to get started!