A Guide to Digital Insurance

Stay competitive in the crowded insurance marketplace – transform operations with our guide to digital insurance.

Read the BlogThe Internet of Things (IoT) is changing the property and casualty insurance space in a very big way. It’s now possible to capture immense amounts of data on everything from a customer’s driving patterns to their fitness level. Providing meaningful data that can be used to power and strengthen a variety of applications such as CRM (Customer Relationship Management) and GIS (Geographic Information System) technology, the IoT is the gateway to growth for P&C insurers.

Yet, with so much opportunity and so much data, the new IoT world can be overwhelming, leaving insurers paralyzed with choice and wondering where to begin.

One logical first step is to focus on GIS technology. IoT networks can now gather data from a host of sources, including GIS technology, creating an ecosystem of connected data that insurers can use to drive innovation and fuel company growth.

GIS is an analytics mapping tool that uses sensors to provide geophysical, topographical, climatological and hydrological data. It can also interpret geocoded data that along with other metadata (such as names, addresses, descriptions) can provide a powerful tool for insurers to learn and adapt. With this data, insurers can better predict and evaluate risk, allowing them to proactively deliver appropriately priced products and services. This is important in a world of instant information, where insurers and agents looking for a competitive advantage must be able to anticipate and proactively service each individual customer’s needs. While GIS technology has been around for decades, the advent of IoT means that GIS software can now integrate with rich data to provide location-based insights in real time. And certain GIS tools can integrate with a company’s critical business systems — making the data not just insightful but actionable.

GIS and Advanced Analytics Capabilities for P&C Insurers

Today’s GIS technology uses big-data analytics capabilities to process and analyze data from several sources such as real-time sensors on vehicles and vessels; and feeds from social media, weather and environmental applications. Using GIS technology, insurers receive the location intelligence they need to aggregate, identify and assess geographic data, and determine the impact of potential risks to policyholders living in that geographic zone. Insurers can also analyze customer demographics in a specific zone, as well as various demographic patterns and behaviors, thus driving better-informed, more targeted sales and marketing efforts.

Real-Time Event Monitoring

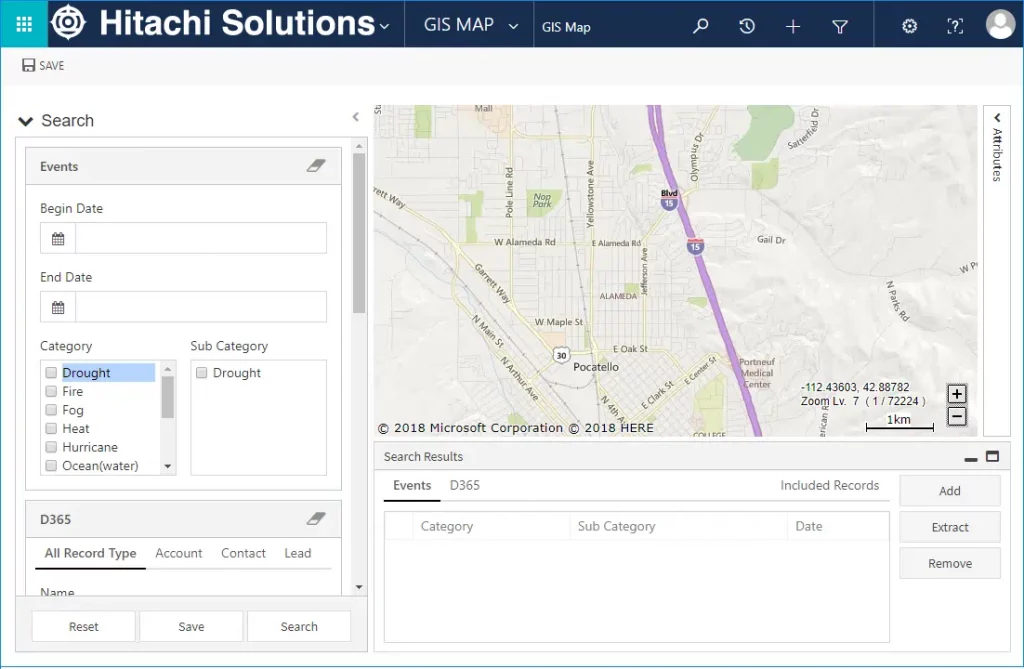

Utilizing real-time GIS updates, businesses can evaluate and leverage streaming data from social media, IoT sensors and devices. With location-based analytics, insurers can filter data so they are alerted to what they care about most.

Integrating GIS with a weather system (such as Weather Underground or NOAA Storm Events) enables insurers to track weather in real time and leverage forecasts on a weather pattern’s predicted path. With this insight, insurers can prepare appropriately, thus helping to expedite claims processing for affected residents and create enormous internal efficiencies.

GIS can also integrate with certain CRMs to display relevant event, demographic and customer data all on one map.

Risk Analysis

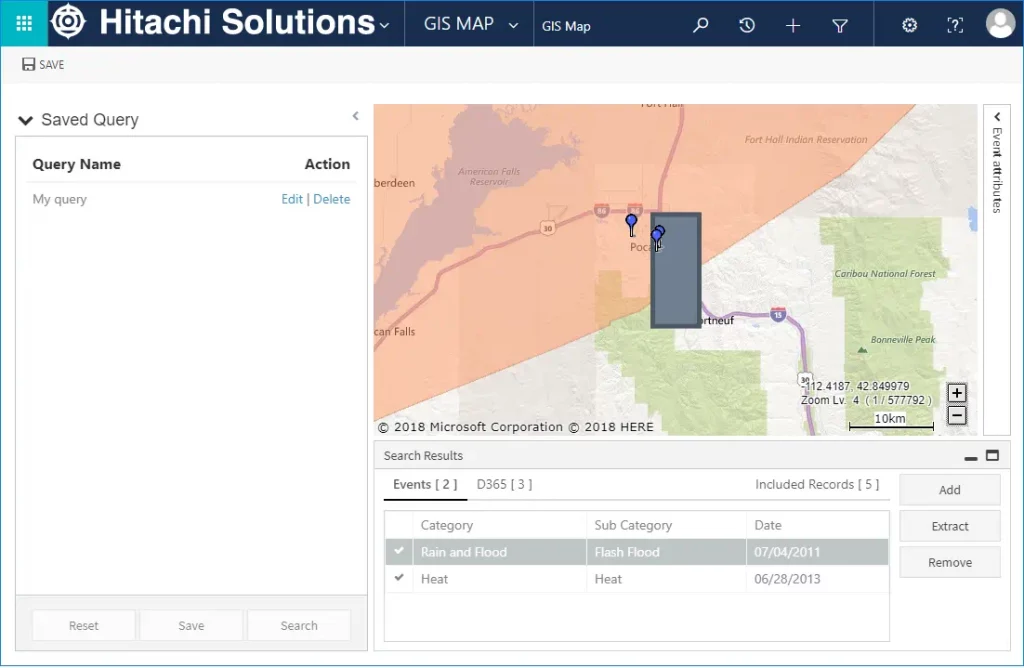

GIS data can provide P&C insurers with indispensable knowledge of catastrophic event patterns and behaviors. Utilizing the insurer’s claim system to find associated catastrophes the GIS system can then use this information to evaluate the likelihood of a repeat event in the given area (whether it’s winter storms, fires, floods, etc.). With this knowledge, insurers can offer strategic policy offerings based on risk.

In addition to weather risk tracking and prediction, GIS also provides insight into other factors that influence policies, such as:

- Power outages: GIS allows insurers to integrate with power companies so they can find and service policyholders in the affected power outage areas.

- Crime: GIS can also integrate with police department activity feed allowing insurers to plot and compare crime rates in different areas — and then price home insurance policies appropriately.

- Property Value: Integration with an online real-estate marketplace, such as Zillow, enables insurers to pinpoint varying property values across locations.

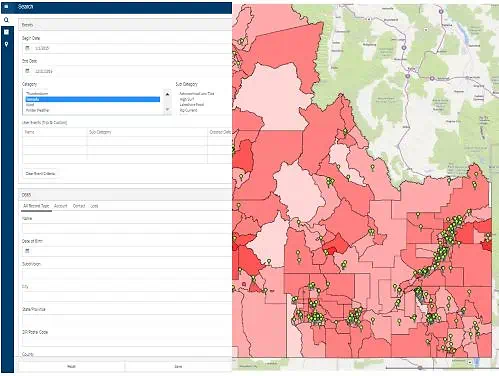

- Demographics: A census heat map can be overlaid on the GIS, allowing insurers to see census data such as age, gender and population density.

- Custom: User created events can be created to group related records based on user-defined criteria available within GIS

Example of a GIS showing customer data overlaid onto a population heat map

Example of a GIS showing Events and D365 records grouped into a custom Event

Route Planning and Optimization

In addition to visually mapping and tracking risk factors, the ability to plot data on a map can also increase agent productivity and efficiency. For instance, mapping and visualization functionality can help agents plan the most efficient route for customer meetings. If an agent has a meeting with John Doe at X location, using GIS he can see that he has five other customers in the same vicinity as John Doe — and hence can schedule all his Tuesday afternoon meetings with his customers in this location.

Not only can he easily identify the customers that are in the same vicinity, but the agent can also use GIS to find the best/quickest route for meeting all of them at their designated times. GIS can send step-by-step directions to the agent’s mobile phone, ensuring he gets to the right place at the right time.

Getting Started with IoT and GIS

By utilizing mapping and spatial reasoning tools to visualize data in real time, insurers can leverage location-based insights that help them improve overall business strategies. Data visualization provided by GIS and the IoT enables P&C insurers to make better decisions, more efficient plans, and improve communication among team members. The IoT is here and insurers ready to embrace the opportunities it offers will position themselves to compete and win in the digital age.

For insurers looking to get started on their journey of digital transformation and embrace the IoT, it can help to partner with an experienced software provider, ideally one that has expertise in the P&C industry. The first step is always the hardest; but it’s easier when you have a partner by your side.